What is a PPA?

What is a PPA?

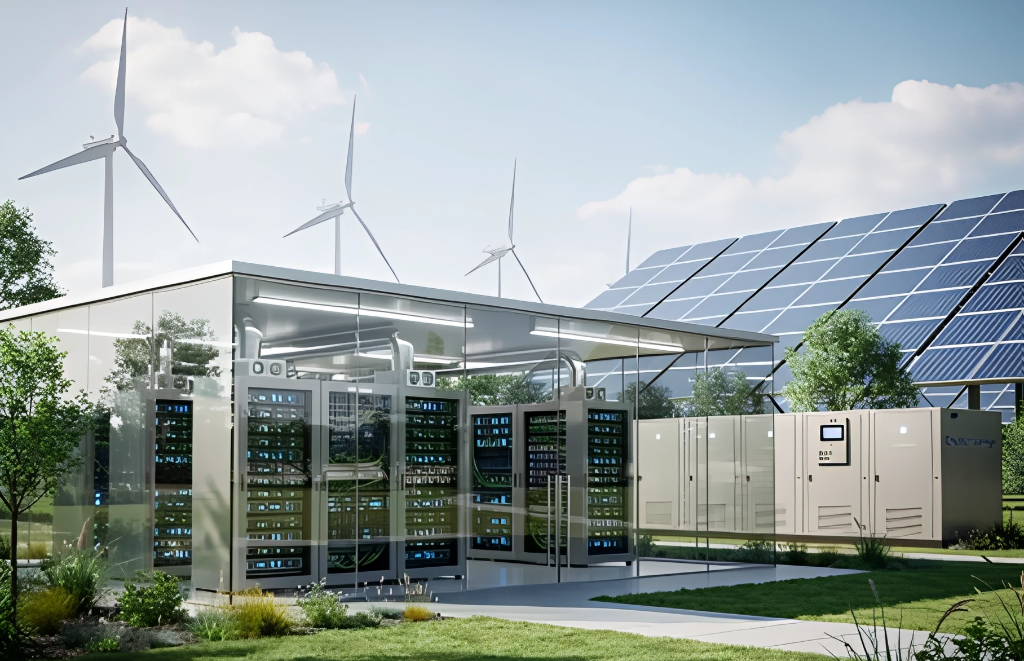

A Power Purchase Agreement (PPA) is a contract between a supplier or a commercial and industrial (C&I) client and a green energy producer (SPV) for the purchase of electricity generated by renewable energy assets. These contracts are typically long-term agreements, with durations ranging from 5 to 20 years.

The client does not own or invest in the renewable energy equipment, such as wind turbines or solar panels, that generate electricity. Instead, the client commits to purchasing the electricity and its associated attributes, such as Renewable Energy Certificates (RECs) or Guarantees of Origin (GOs), produced by the supplier’s installed equipment.

Why Are PPAs Important?

A Power Purchase Agreement can be beneficial for several reasons.

A PPA is an alternative to direct investment in renewable energy projects, making it particularly attractive for commercial and industrial clients who may lack the technical expertise to manage such projects. It eliminates the risks associated with project development and equipment ownership for both parties.

A PPA allows C&I consumers to hedge against future electricity price increases while providing renewable energy developers with access to long-term buyers. Moreover, PPAs are crucial for financing renewable energy projects.

PPAs are key drivers of the energy transition, playing a central role in corporate sustainability strategies (CSR) by demonstrating a commitment to clean energy to stakeholders, including customers, employees, shareholders, banks, and governments.

PPAs also serve as financial tools, helping businesses reduce energy costs and mitigate risks through long-term price stability.

Types of PPAs

Direct/Sleeved PPA

A sleeved PPA is an agreement between an electricity producer and a consumer, where both parties agree on a fixed or indexed price for a defined period. An energy supplier acts as an intermediary, ensuring the transfer of electricity between the producer and the consumer. The supplier delivers the energy through the grid and may charge a sleeving fee for this service. If necessary, additional energy is supplied either by the same provider or another source.

However, sleeved PPAs have some drawbacks:

- They are more complex than financial PPAs.

- They require short-term complementary supply agreements.

- The electricity supply depends on the performance of the renewable asset.

Virtual/Financial PPA

A virtual PPA is a financial contract that does not involve the physical delivery of electricity between the parties. Instead, it is a financial structure, also known as a Contract for Difference (CfD), where the consumer and the green energy producer agree on a fixed price. The producer sells the electricity in the wholesale market, and the supplier (potentially) compensates for the difference between the fixed price and the market price (SPOT price).

A financial PPA is less complex than a sleeved PPA because:

- It can be classified as a financial derivative (IFRS 9).

- It may require hedging strategies to manage contractual risks.

Who Can Benefit from a PPA?

PPAs have become increasingly common in recent years, offering a popular way to develop renewable energy projects. They can have short- or long-term durations, typically ranging from 1 to 25 years, with varying pricing structures.

Both energy buyers and sellers can benefit from PPAs to meet their renewable energy goals.

Energy buyers typically include companies with high electricity demand for their operations or utility companies. Energy sellers can be infrastructure funds investing in renewable energy, independent power producers (IPPs), or companies looking to develop their own renewable assets.

Why Choose Greensolver for PPA Advisory Services?

Greensolver understands the volatility of energy markets and offers a range of customized solutions tailored to your needs. We provide both standalone services and end-to-end PPA support, guiding clients from initial strategy development to contract finalization.

Our services include PPA structuring, pricing, performance analysis, negotiations on behalf of clients, and much more.

Click here to learn more about our full range of PPA advisory services.