Tales of BESS #10 - Case study: Technical Due Diligence on two Greek BESS projects: Totaling 100MW / 200MWh (GRC)

Tales of BESS #10 – Case study: Technical Due Diligence on two Greek BESS projects: Totaling 100MW / 200MWh (GRC)

Technical Due Diligence on two Greek BESS projects: Totaling 100MW / 200MWh (GRC)

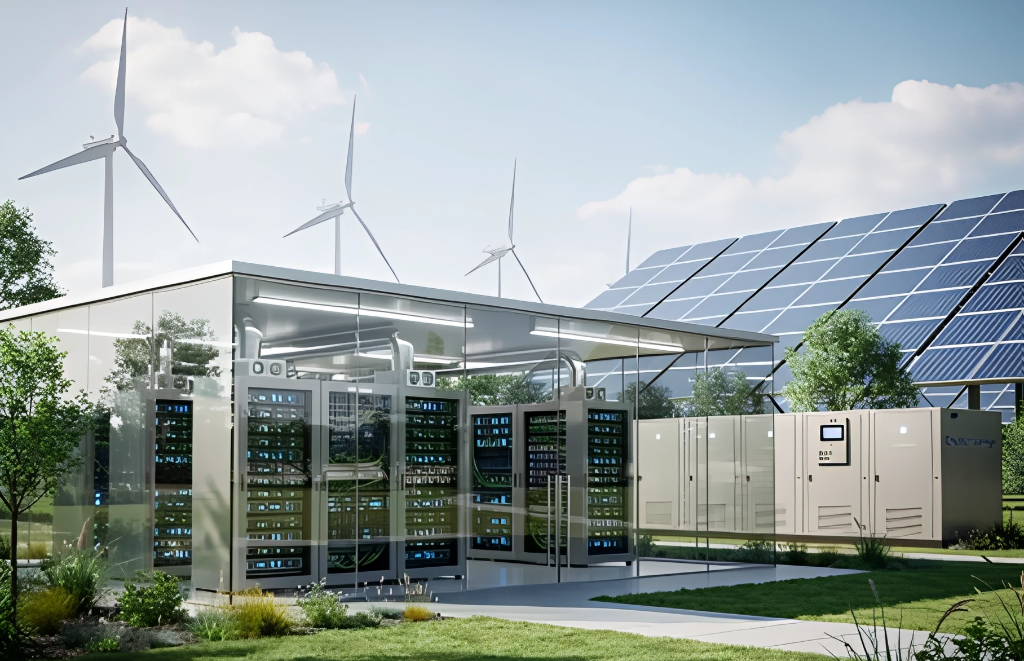

As the Lender Technical Advisor, Greensolver conducted Technical Due Diligence for two standalone BESS assets 50MW/100MWh in the context of the project’s financing.

The scope of the work covered:

- Regulatory:

- Review of grant requirements and tracking of its development

- Application of evolving regulatory requirements to technical specifications and financial model

- Technical:

- Review of CATL’s BESS (Model: EnerC+)

- Review of the permits and licenses

- Site Assessment and Review of the proposed layout

- Design review and capacity to operate on primary reserve markets

- Contracts review (Supply Agreement, EPC, and O&M)

- Augmentation Strategy Evaluation

- Review of grant compliance

- Financial:

- Review of the financial model, validating assumptions and proposing suitable parameters where required CAPEX, OPEX, budgets, revenues)

- Review of grant compliance

Through the Greensolver’s audit of the project, the proposed system was found to be aligned with industry standards. Minor risk from the selected site was identified, with mitigation investigated and proposed. The Financial Model was found to require revision and was therefore updated to better reflect local conditions.

Written by Nikko Talplacido