Spain’s Renewable Energy Landscape 2026 : Opportunities and Challenges

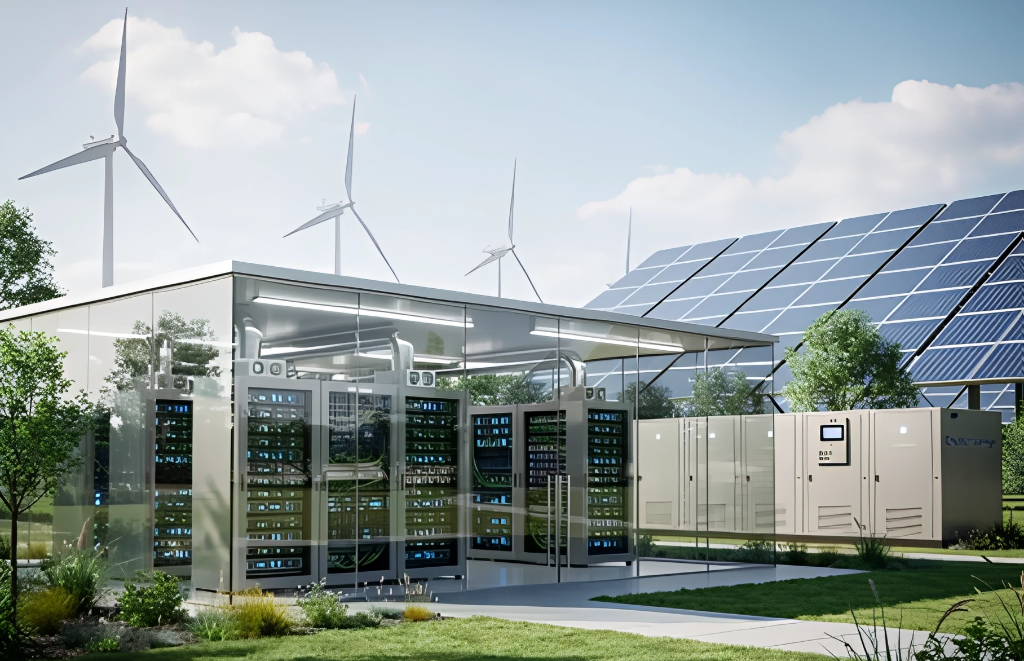

Spain has rapidly established itself as one of Europe’s most dynamic renewable energy markets: in 2025, the country has seen the installation of more than 8 GWc of PV and 1 GW of wind power. Spain’s energy mix is now dominated by low-carbon renewable energy sources. With record growth in installed capacity and ambitious national targets, market activity is intense but not without structural and regulatory challenges that require deep technical insight. This strong growth trajectory presents major opportunities for investors, technology providers, and service firms.

Key Opportunities

- Strong and ambitious targets: Spain’s national targets are clearly bold but achievable, with targets of 76GW of PV, 62GW of wind power and 23GW of BESS to be reached by 2030. These targets bring real and reliable opportunities for investors and developers!

- Massive Project Pipeline and Investment Flows : Over 100 GW of solar projects are already planned in Spain, making it one of Europe’s largest pipelines. For projects nearing the end of their life cycle, repowering potential reshuffles the deck and enables the creation of ever more present and relevant value.

- Emerging Technologies and New Value Pools: Beyond solar and wind, energy storage is also expanding as strategic asset as a key to managing intermittent generation and enhancing grid flexibility and is now incentivized through regulatory reforms in Spain Recent investment announcements (both national and European) are real catalysts for the development of these resources.

- Competitive Edge for Industrial Investors: Low renewable electricity costs in Spain are creating a competitive advantage for energy–intensive industries, attracting new industrial investments and boosting economic growth prospects.

Major Challenges

- Grid Saturation and Infrastructure Bottlenecks: Spain’s high congestion in the transmission grid, with over 80% of nodes saturated, delays projects and increases operational and financial risks.

- Permitting Delays and Regulatory Complexity: Lengthy permits and regulatory hurdles slow projects and increase risk, making technical due diligence essential for predictable, confident investments.

- Market Dynamics and Profitability Pressures : Solar oversupply is lowering electricity prices, reducing asset profitability and prompting developers to explore storage or hybrid solutions.

Why Technical Due Diligence Matters in Spain 2026

As Spain’s renewable sector evolves, technical due diligence is no longer a “nicetohave”, it’s a strategic necessity. What Greensolver can help you with :

- Mitigate grid and regulatory risks through detailed connection and permitting audits.

- Validate asset performance and integration feasibility for wind, PV, storage, and hybrid systems.

- Inform investment valuations and financing terms with precise engineering and market forecasts.

- Support M&A, refinancing, and development thanks to our expertise in asset management and technical and financial due diligence

- Support your storage project by auditing the BESS contractual layout (EPC, O&M, Supply, etc.) in line with European industry standards, bearing in mind that large-scale battery storage deployment is still at an early stage in Spain compared to other European markets.

If you’re looking to explore the Spanish market or are already active in it, don’t hesitate to contact Greensolver for more information and expert support!

Written by Paula Ortega