How to Build Reliable BESS Projects in Greece?

Dear Partners,

The Greek electricity market is entering a new phase, where the rapid penetration of Renewable Energy Sources (RES) makes flexibility and energy storage a necessary condition for the viability of RES projects. Energy storage systems (BESS) are emerging as critical infrastructure, but at the same time, as a relatively new technology, requiring careful planning and a well-documented approach.

Production Curtailments and Technological Uncertainty

The ongoing development of new RES projects – primarily photovoltaic – has already led to significant production curtailments, as consumption needs do not always coincide with generation. It is estimated that curtailments in 2025 exceeded 7% of RES generation, and the figure could double in 2026.

Despite the obvious need for storage, BESS is still a new technology in the Greek market, with limited track record under real operating conditions. This results in:

- increased caution on the part of investors,

- a conservative approach from banks,

- a need for technical documentation, reliable financial forecasts, and guarantees for safe operation.

Regulatory Framework Supporting Storage

The regulatory framework recently created opportunities for the development of energy storage systems:

- With the Ministerial Decision of the Ministry of Environment and Energy (March 2025), a priority scheme for connection terms of standalone storage systems was established.

- At the same time, the framework allows for the addition of batteries to existing or new RES projects, reducing curtailments and increasing the operational value of the projects.

- Furthermore, significant opportunities arise for industrial storage applications, either for self-consumption and peak shaving or for optimizing energy costs and market participation.

This framework allows for the development of BESS on a merchant basis, with the technical and financial robustness of projects being a critical factor.

Greensolver’s Contribution

In an environment where energy storage is necessary but technologically and financially challenging, Greensolver acts as a risk-mitigation catalyst for investors and financiers.

With extensive experience in BESS across multiple European countries and an active presence in the Greek market over the last four years, we provide all the necessary assurances to ensure that:

- the investment is properly designed from the outset,

- it is based on realistic technical and financial assumptions,

- it operates smoothly throughout its lifetime.

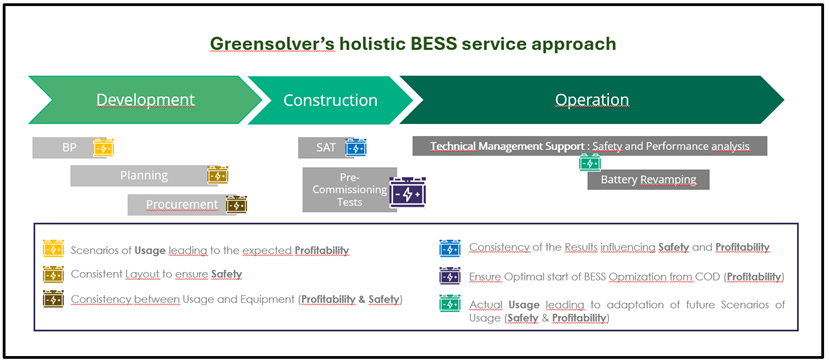

Our support covers the entire lifecycle of a storage project:

- Market and regulatory framework analysis

- Development/evaluation of business models and revenue analysis

- Rational sizing and technical system design

- Evaluation and selection of reliable equipment (BESS OEM, PCS, EMS)

- Technical Due Diligence for investors and banks

- Construction supervision, commissioning support, and performance testing

- Asset Management during the operational phase

In this way, Greensolver ensures that BESS projects become bankable, technically reliable, and long-term sustainable investments, without unforeseen costs, while minimizing operational risks.

Our team is at your disposal to discuss how we can support your next steps in the sector.

Written by Dr. Alexander Zachariou