Data Centers and Renewable Energy in Europe: The Symbiosis Redefining Investment

Data centers have become one of the most critical and sought-after infrastructures in the European economy. Long perceived as technical assets, they are now analyzed as energy platforms, where profitability depends as much on electricity costs as on digital connectivity.

France: Between Attractiveness and Constraints

In France, this evolution is accelerating with the growth of cloud computing, AI, and the imperatives of digital sovereignty. Greensolver emphasizes that access to competitive, reliable, and decarbonized energy is becoming a key factor in valuation for operators and investors.

With 273 data centers, France ranks among the main European markets. Paris belongs to the circle of major hubs (London, Frankfurt, Amsterdam, Dublin), but this concentration leads to network saturation and rising rents (+36% to +50% since 2022). Greensolver observes that investors are turning to Lyon, Marseille, or Lille, where costs are more moderate and access to renewable energy is easier.

A Solid Model, But Exposed to Energy Risk

Developing a greenfield data center represents on average €8.5 to €12 million per MW, including land, construction, and electrical infrastructure. Revenues come from multi-year contracts with Service Level Agreements (SLAs) guaranteeing near-100% availability. This visibility attracts infrastructure funds and private equity. But electricity, which accounts for 20% to 50% of OPEX, has become the main risk. Greensolver points out that price volatility is profoundly changing the financial equation.

When the Data Center Becomes an Energy Asset

Data centers consume 1.5% of global electricity, a share expected to double by 2030. The energy consumption of a data center depends on its size, server configuration, and continuous operation. The largest sites can reach 50 to 200 MW, equivalent to the needs of a small city.

Securing energy is becoming as strategic as securing land. For a data center, cost stability and supply continuity are vital. Greensolver highlights several levers to link renewable energy and digital infrastructure:

- Power Purchase Agreements (PPAs): These long-term contracts (10 to 20 years) fix the price of electricity, reducing market volatility and securing cash flow.

- On-site Solar Generation: Producing locally via photovoltaic panels installed on rooftops or parking areas. This approach allows local consumption at marginal cost, reduces grid losses and transmission constraints, and improves energy resilience in case of stress.

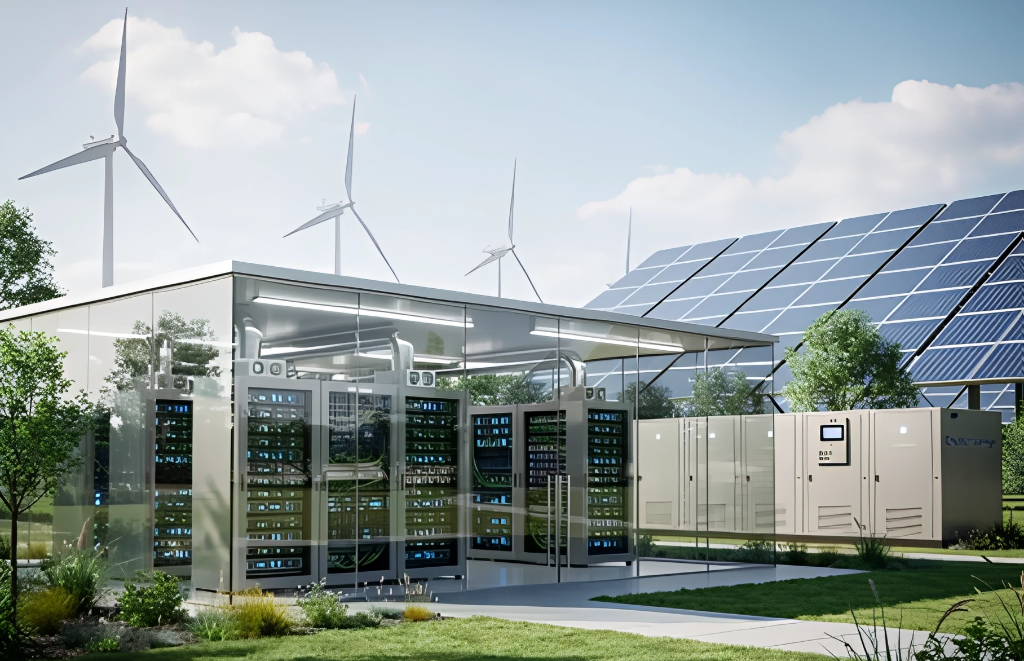

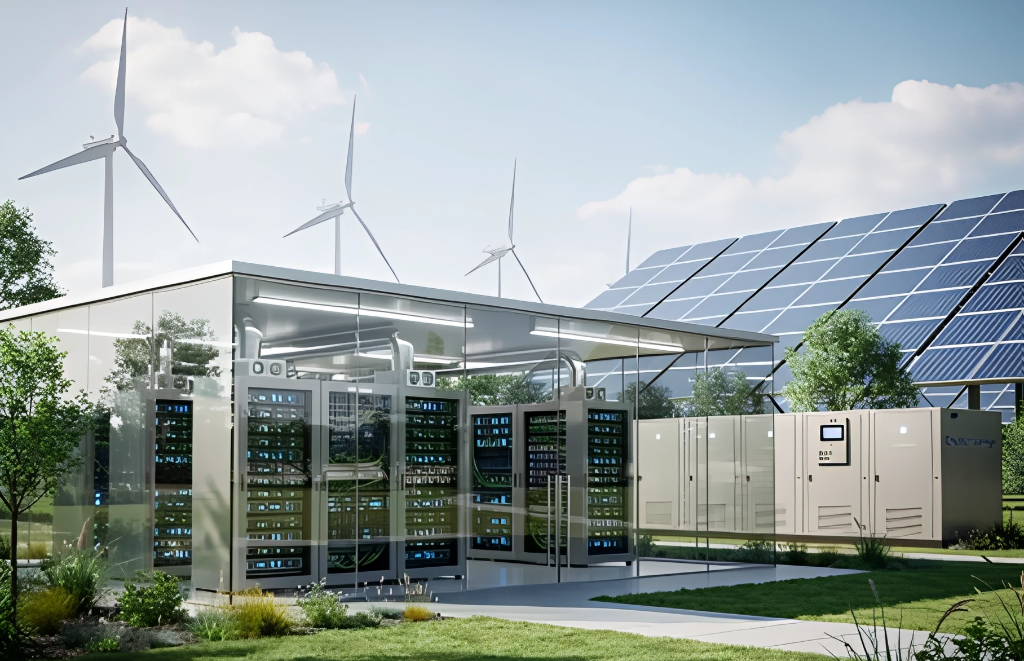

- Microgrids: Autonomous networks combining local generation (solar, wind), storage, and smart management. This enables a data center to operate in island mode off grid in case of an incident, while optimizing costs and carbon performance in real time.

- Battery Energy Storage Systems (BESS): Complements this setup by absorbing surpluses and ensuring continuity during peaks or outages, reducing the risk of interruption.

- Co-location with Renewable Parks (solar or wind): Physical proximity secures supply and creates contractual and technical synergies.

Regulation and Value Creation

The European Energy Efficiency Directive (EED) requires data centers over 500 kW to publish annually their energy consumption, efficiency (Power Usage Effectiveness), and share of renewable energy. These data, made public, establish total transparency.

For those not integrating renewables, the risk is clear: degraded image, increased competitive pressure, and exposure to price volatility. Clients and investors sensitive to ESG criteria will compare and favor players committed to decarbonization. EED turns energy performance into a strategic criterion: not investing in renewables means losing competitiveness.

Moreover, assets heavily integrating renewables benefit from better access to financing and a valuation premium during M&A transactions.

As electricity becomes the dominant constraint, data centers cease to be mere technical real estate assets: they become integrated energy assets, at the heart of the next investment wave in Europe. Should you have any questions, don’t hesitate to get in touch with Greensolver, which positions itself as the strategic partner to turn this constraint into opportunity and maximize value for investors.

Written by Antra Ramboarison